Mobile wallets have revolutionized the way we pay for goods and services. As physical wallets gradually become obsolete, digital alternatives like Samsung Pay, Google Pay, and other Android-based payment platforms have grown in prominence. Among these, Samsung Pay stands out with its distinct features and user-centric innovations. In this review, we’ll explore Samsung Pay in-depth, comparing it against Google Pay and other Android mobile payment solutions to help you decide which one best fits your lifestyle.

What is Samsung Pay?

Table of Contents

Launched in 2015, Samsung Pay is Samsung’s proprietary digital wallet and online payment platform designed for their range of smartphones, smartwatches, and some tablets. At its core, it allows users to make contactless payments via NFC (Near Field Communication) technology. But what separates Samsung Pay from competitors is its now-retired MST (Magnetic Secure Transmission) technology, which once provided near-universal compatibility with traditional card readers.

Since MST has recently been phased out in many regions, Samsung Pay now primarily relies on NFC payments—making it more in line with Google Pay and Apple Pay in terms of hardware compatibility.

Key Features of Samsung Pay

Samsung Pay offers several noteworthy features that give it an edge over some alternatives:

- Wide Device Support: Available on most Samsung Galaxy smartphones and Galaxy smartwatches.

- Samsung Wallet Integration: Merges loyalty cards, digital keys, boarding passes, and even cryptocurrency (in select markets) under one interface.

- Tokenization and Knox Security: Every transaction is encrypted and authenticated via biometric or PIN, safeguarding against fraud and unauthorized use.

- In-App and Online Purchases: Aside from point-of-sale (POS) purchases, Samsung Pay supports online payments where accepted.

- Rewards Program: Samsung Rewards offers users points for every purchase, redeemable for discounts and gifts.

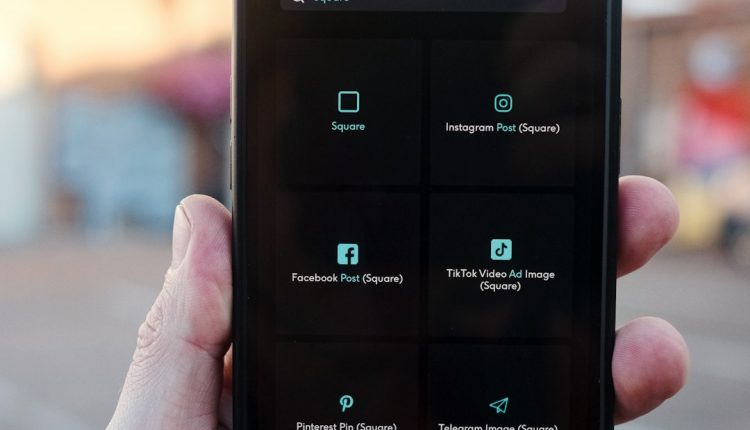

samsung phone, digital wallet, mobile payment</ai-img]

samsung phone, digital wallet, mobile payment</ai-img]

Ease of Use

Samsung Pay is designed with usability in mind. Once a card is registered, users can simply swipe up from the bottom of the screen (on supported devices), authenticate via fingerprint, PIN, or iris scan, and place the device next to the POS terminal. The entire process takes seconds and is generally reliable with modern NFC terminals.

Device compatibility is, however, a limiting factor. Unlike Google Pay, which is accessible on a wide variety of Android devices, Samsung Pay remains exclusive to Samsung hardware. This exclusivity can be a double-edged sword—leading to better optimization on one hand but limiting accessibility on the other.

Security

Samsung Knox forms the backbone of Samsung Pay’s security infrastructure. It provides real-time monitoring and protection against malicious threats. In addition, the payment system leverages tokenization to ensure that the card details are never actually shared with merchants.

Each time a transaction is conducted, Samsung Pay sends a randomized token instead of an actual credit card number. Combined with biometric authentication options like fingerprint and facial recognition, this minimizes the risk of fraud.

Samsung’s commitment to security positions its payment solution as one of the more trustworthy options in the mobile payment ecosystem.

Samsung Pay vs Google Pay

When comparing Samsung Pay to Google Pay, several differences become evident. Both platforms offer contactless payments, loyalty card storage, and secure transactions. However, certain distinctions may sway users one way or the other.

| Feature | Samsung Pay | Google Pay |

|---|---|---|

| Device Compatibility | Samsung devices only | All Android phones (select smartwatches) |

| Interface | Integrated with Samsung Ecosystem | Google Material Design, integrates with broader services like Gmail |

| Security | Samsung Knox + Tokenization | Google Security Framework + Tokenization |

| Loyalty & Rewards | Samsung Rewards program | No built-in rewards, relies on retailer programs |

| Transit Integration | Limited city and country coverage | Wider support in global transit systems |

One of Samsung Pay’s longstanding advantages—the MST technology—has now been largely retired, narrowing the gap between it and Google Pay. With MST gone, both services are nearly identical in their reliance on NFC for transaction processing.

How Does Samsung Pay Compare to Other Android Alternatives?

Beyond Google Pay, there are a few other alternatives for Android users, most notably:

- PayPal: Available for in-app and some in-store NFC payments.

- Bank-Specific Apps: Many banks offer proprietary mobile wallets, which may lack advanced features or wide support.

- Venmo, Cash App, and Others: Ideal for peer-to-peer transactions but limited retail support.

mobile payments, phone comparison, digital transaction</ai-img]

mobile payments, phone comparison, digital transaction</ai-img]

While these alternatives serve various purposes, none offer the cohesive and polished experience that Samsung Pay and Google Pay provide. Samsung Pay has a slight edge in terms of integrating deeply with its hardware, whereas alternatives usually offer broader but shallower compatibility.

Pros and Cons of Samsung Pay

To simplify your decision-making process, here are the main pros and cons of using Samsung Pay:

Pros

- Seamless integration with Samsung devices including wearables.

- Highly secure environment using Knox and tokenization.

- Samsung Rewards provides an incentive to use regularly.

- Uncluttered interface and user-friendly setup.

Cons

- Limited to Samsung users, reducing its accessibility.

- Loss of MST feature limits backward compatibility with older card readers.

- Limited support in smaller markets and for some banks or cards.

The Verdict

Samsung Pay is a powerful and secure mobile payment solution, particularly well-suited to those already embedded within the Samsung ecosystem. While the phasing out of MST technology has brought its capabilities closer to Google Pay, it still offers a streamlined experience that many users will appreciate—especially those who prefer stock Samsung apps or are already taking advantage of the broader Samsung Wallet functionalities.

However, those using non-Samsung Android phones or seeking maximum compatibility across devices would likely be better served by Google Pay. It boasts broader hardware support and better integration with other Google services, making it a compelling choice for a wider audience.

In conclusion, the best mobile payment solution often comes down to your device, your payment habits, and the depth of integration you desire. For Samsung users, Samsung Pay remains a solid and reliable option in 2024.

contactless payment, nfc transaction, samsung pay terminal

contactless payment, nfc transaction, samsung pay terminal